This is why any effort to cut expenses will also often have to be accompanied by a shift in mindset.”īarker said reducing spending to achieve financial goals, including paying off debt, shouldn’t be seen as a sacrifice. At the same time, for many of us, carrying debt is also seen as completely normal - which it absolutely shouldn’t be. “Many people are reluctant to cut expenses, as they simply believe it’s too hard,” said Anna Barker, of LogicalDollar, a money management firm “As we become used to living a certain way, the idea of making changes that may force us to cut back on things that we consider completely normal and essential to our lives is incomprehensible to a lot of us. The easiest way is to cut expenses and use the money to pay off debt. So how do we bring that stack of debt down to earth? If you stacked that amount of debt in one-dollar bills, it would reach all the way to the moon. was a record $14.6 trillion for the first quarter of 2021, which seems like a lot of debt and it is.

#HOUSEHOLD BUDGET CODE#

Tax Code Encourage ‘Tax Avoidance’? April 16, 2013 Tax Season Countdown All Over Again June 30, 2020.Payroll Tax Deferral: Is It Worth It? September 11, 2020.How Biden & Trump Tax Policies Compare October 2, 2020.Paying Down Student Loans Before the COVID Suspension Is Lifted October 28, 2020.Google Is the Latest Company to Offer Student Loan Repayment Benefits November 3, 2020.

#HOUSEHOLD BUDGET HOW TO#

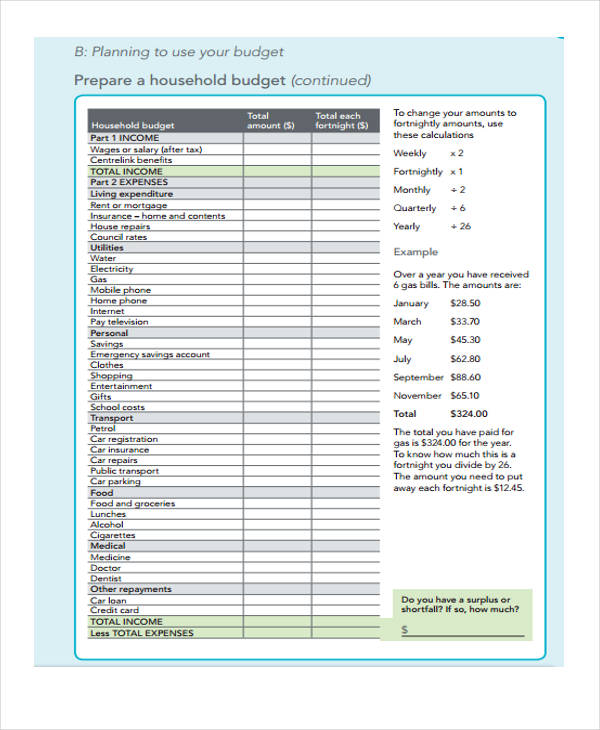

Since you’re creating this budget from scratch, you can make it as high-level or detailed as you want. Or, you can add sections for savings and investments or various sections for different types of expenses. For example, you can see the total salary amount as it grows throughout the year. If you want more detail for your income and expenses, you can add totals for each row too.

0 kommentar(er)

0 kommentar(er)